|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

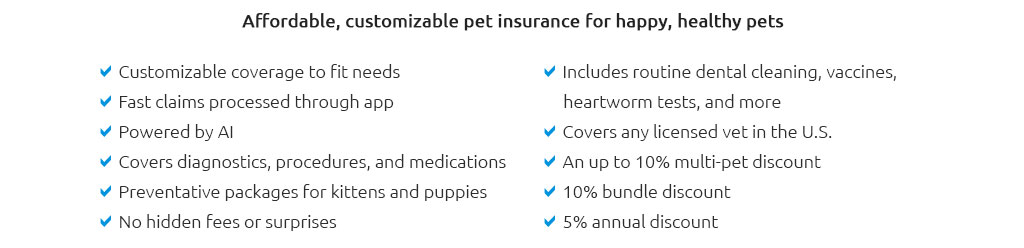

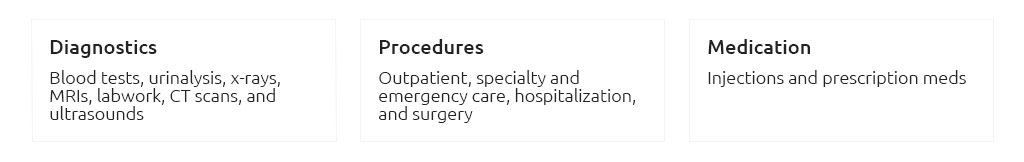

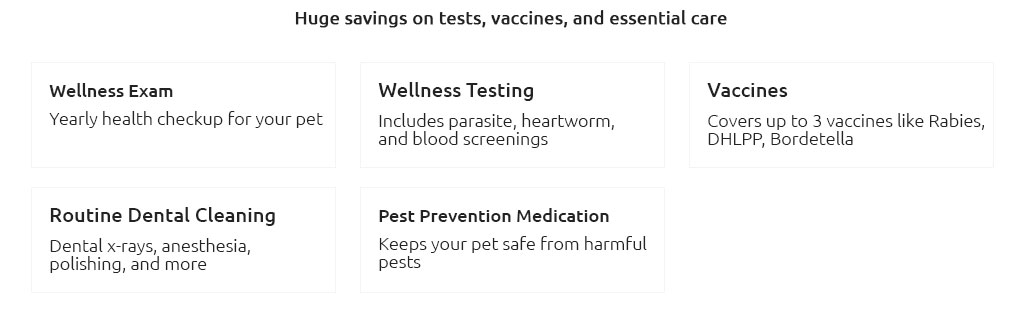

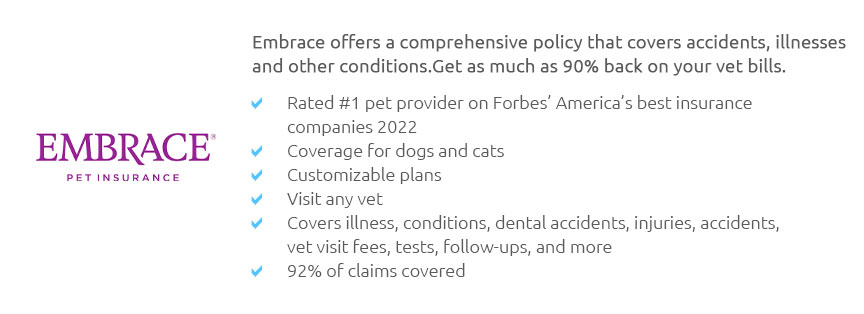

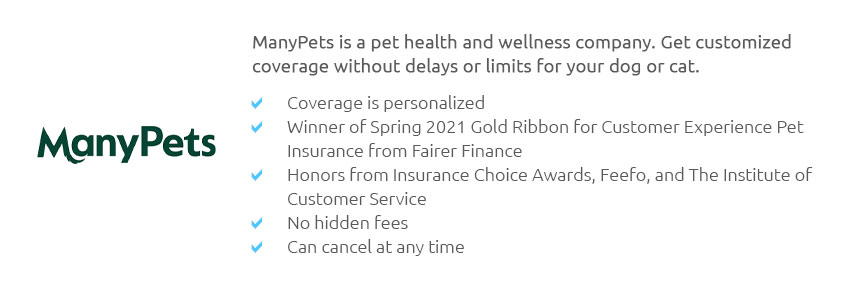

Best Pet Insurance Reviews: What to ExpectWhen it comes to protecting our furry family members, pet insurance has emerged as a prudent investment, yet choosing the right policy can be an overwhelming endeavor. Navigating through the myriad options requires a nuanced understanding of what different companies offer, and more importantly, what pet owners should expect from these services. In this article, we dive into some of the best pet insurance reviews to provide you with a comprehensive perspective on the industry's top contenders. Understanding Coverage Options Before diving into reviews, it is crucial to comprehend the types of coverage available. Generally, pet insurance policies fall into several categories: accident-only, accident and illness, and comprehensive plans that may cover wellness exams and preventive care. The level of coverage you choose should align with your pet’s needs and your financial capacity. It’s important to note that pre-existing conditions are typically not covered, a common thread across most providers, which some pet owners find frustrating yet understandable from a risk management perspective. Top Contenders in Pet Insurance Embrace Pet Insurance is frequently lauded for its extensive coverage options and flexibility. Reviews highlight their wellness rewards program, which reimburses routine care expenses, a feature that many competitors lack. Customers appreciate the customizable plans, which allow pet owners to tailor deductibles and reimbursement levels, making it a popular choice among budget-conscious owners seeking comprehensive protection. Healthy Paws, another leading provider, consistently receives high marks for its straightforward policies and excellent customer service. Their no-cap coverage on claims is particularly appealing, offering peace of mind for pet owners worried about costly treatments. However, some reviews mention that Healthy Paws does not offer wellness plans, which might be a drawback for those looking for more inclusive packages. Trupanion stands out with its unique approach to coverage. Unlike many insurers, Trupanion pays the veterinary clinic directly, minimizing out-of-pocket expenses for policyholders. This feature, combined with their lifetime per condition deductible, which is particularly beneficial for chronic conditions, has garnered positive feedback. However, the absence of a wellness plan and potential premium increases as pets age are points to consider. Important Considerations When reading pet insurance reviews, consider not only the coverage but also the claims process, customer service quality, and company reputation. The ease of submitting claims and receiving reimbursements can significantly affect your overall satisfaction. Many reviews stress the importance of reading the fine print to understand exclusions and limitations, which can differ significantly between providers.

In conclusion, selecting the right pet insurance requires careful consideration of your pet's specific needs, your financial situation, and the reputation of the insurer. By examining pet insurance reviews, you can gain insights into the strengths and weaknesses of each provider, helping you make an informed decision that ensures your beloved companion receives the best possible care without causing undue financial strain. Ultimately, the peace of mind that comes with knowing your pet is protected is invaluable, making the time spent researching well worth the effort. https://www.goldenretrieverforum.com/threads/pets-best-embrace-figo.521254/

Pet's Best has been great for us. More affordable than many other options and the biggest plus for me is they will cover exam fees. https://www.reddit.com/r/puppy101/comments/ol2yph/petsbest_insurance_experience/

It was not worth it honestly. I paid $70 a month into that insurance and they didn't reimburse some things because I had to meet the $250 ... https://www.facebook.com/groups/petinsuranceadvice/posts/1658002861797556/

Reviews on Pets Best. Can I cancel anytime? Also, my first time getting my goldendoodle insurance, so how do pet insurance works?

|